Health News

- 3,047 Got Private Health Insurance In Special March-april Signup Designed To Avoid Or Reduce Tax Penalty For Not Being Covered

More than 3,000 Kentuckians signed up for health coverage during a special March-April enrollment period that allowed them to avoid or reduce tax penalties for being uninsured. "At the Feb. 15 close of the 2015 open enrollment period, 158,685 individuals...

- Obamacare Deadline Is Extended For Those Who Had Technical Problems; State May Also Extend It For Those Facing A Tax Penalty

Were you unable to sign up for Kynect health insurance by the Sunday deadline because of technical problems? You now have until Feb. 28 to sign up. "And like other states and the federal government, Kentucky officials are also considering a 'special...

- Thousands Of Kentuckians Face Federal Tax Penalty For Not Having Health Insurance

"Thousands of Kentuckians might face a penalty this tax season for failing to sign up for health insurance during 2014," Mary Meehan reports for the Lexington Herald-Leader. The state estimated that 340,000 Kentuckians would buy private insurance through...

- Feb. 15 Is Deadline To Get Health Insurance; Those Who Don't Can Be Penalized Up To 2 Percent Of Their Annual Income

Sunday, Feb. 15 at 11:59 p.m. is the deadline to buy private, subsidized health insurance through Kynect, the state-run marketplace created under federal health reform. If your annual income is above the federal poverty level and you don't buy a policy...

- Penalty For Those Without Health Insurance In 2015 Will Be Significantly Higher Than For 2014; Feb. 15 Is Deadline To Sign Up

Wall Street Journal photo illustrationOne aspect of the Patient Protection and Affordable Care Act supporters don't spend much time talking about is the part of the law that imposes a penalty on those who don't have insurance, but the time has...

Health News

As tax deadline nears, most uninsured appear likely to choose penalty; some with coverage are having to refund part of subsidy

Kentucky Health News

Most people facing a tax penalty for not having health insurance appear likely to pay it instead of taking advantage of a special opportunity to but coverage and minimize the penalty.

"Major tax-preparation firms say many customers are paying the penalty and not getting health insurance," reports Stephanie Armour of The Wall Street Journal. "Research also suggests that many people who lack health insurance will pay the penalty and not get covered this year."

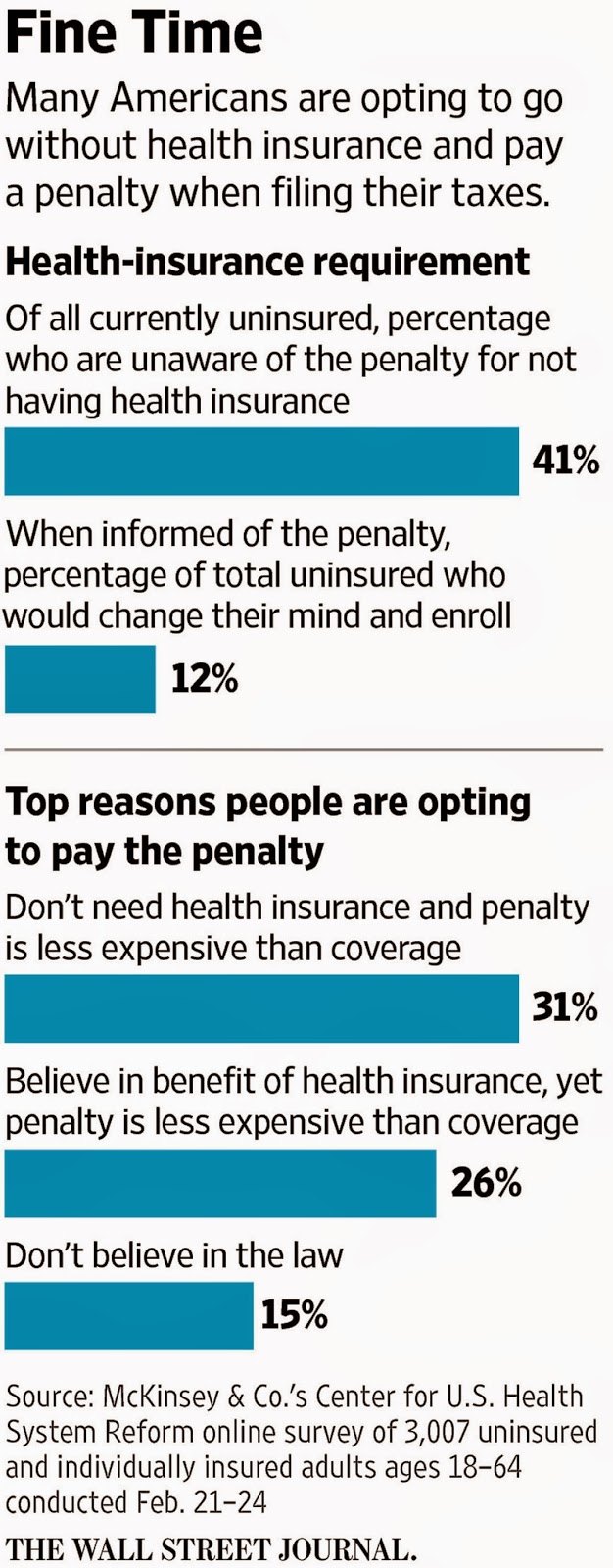

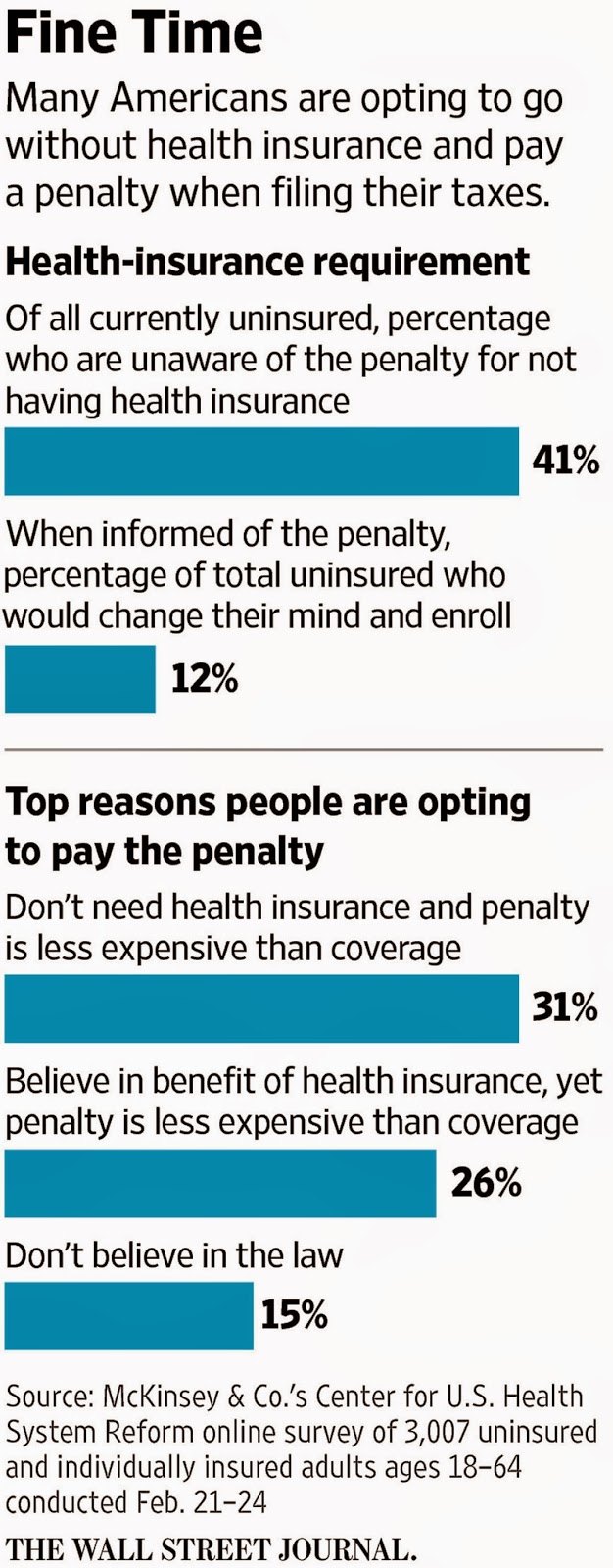

Many polls have found that many if not most people without health insurance are unaware that they are subject to a tax penalty under the federal health-reform law. That percentage appears to be declining as they prepare their income-tax returns, but a poll taken in late February found that when told of the penalty, only 12 percent of the uninsured said they would get coverage.

Many polls have found that many if not most people without health insurance are unaware that they are subject to a tax penalty under the federal health-reform law. That percentage appears to be declining as they prepare their income-tax returns, but a poll taken in late February found that when told of the penalty, only 12 percent of the uninsured said they would get coverage.

For many people, the choice is simply financial, since coverage for them would be more expensive than the penalty -- 1 percent of their income, or $95 per adult or $47.50 per child, whichever is larger. Others say they don't need coverage, and some object to the penalty or the law altogether.

The penalty will increase to 2 percent of income and $325 per adult or $167.50 per child for the 2015 tax year, so if you are uninsured and don't qualify for Medicaid or one of the law's exemptions, the end of the special enrollment period, April 30, is the last chance to avoid that penalty.

"In late February, H & R Block reported that its uninsured clients had paid an average penalty of $172," reports Abby Goodnough of The New York Times. "The money comes out of refunds, while people who do not get refunds are required to pay the Internal Revenue Service by April 15."

Some people who have coverage "might find another unpleasant surprise: As many as half the nearly 7 million Americans who got subsidies to offset their premiums may have to refund money to the government, according to an estimate by H & R Block," the Journal reports. "The subsidies are based on consumers? own projections of their 2014 income, but some estimated incorrectly and received overly generous credits. Those people will see smaller-than-expected refunds or could owe the government money."

"H & R Block also found that as of Feb. 24, just over half of its clients with subsidized marketplace coverage had to repay a portion of their subsidy because their 2014 income turned out to be higher than what they estimated when they applied for coverage," the Times reports. "The process includes "new forms that even seasoned preparers are finding confusing."

The Obama administration announced last month that 800,000 people with insurance bought under the reform law had received incorrect information needed for their tax returns. About 10 percent of them have still not received corrected forms, it announced Friday. "The administration said people who have not received the corrected forms do not have to wait to file their taxes and will not have to pay any additional tax due to the effort," The Hill reports.

The Wall Street Journal reports, "Consumers who already filed their tax returns using the incorrect forms provided though state or federal exchanges won?t be required to file amended forms, and the Internal Revenue Service won?t assess additional taxes, said Mark Mazur, the Treasury Department?s assistant secretary for tax policy."

Most people facing a tax penalty for not having health insurance appear likely to pay it instead of taking advantage of a special opportunity to but coverage and minimize the penalty.

"Major tax-preparation firms say many customers are paying the penalty and not getting health insurance," reports Stephanie Armour of The Wall Street Journal. "Research also suggests that many people who lack health insurance will pay the penalty and not get covered this year."

For many people, the choice is simply financial, since coverage for them would be more expensive than the penalty -- 1 percent of their income, or $95 per adult or $47.50 per child, whichever is larger. Others say they don't need coverage, and some object to the penalty or the law altogether.

The penalty will increase to 2 percent of income and $325 per adult or $167.50 per child for the 2015 tax year, so if you are uninsured and don't qualify for Medicaid or one of the law's exemptions, the end of the special enrollment period, April 30, is the last chance to avoid that penalty.

"In late February, H & R Block reported that its uninsured clients had paid an average penalty of $172," reports Abby Goodnough of The New York Times. "The money comes out of refunds, while people who do not get refunds are required to pay the Internal Revenue Service by April 15."

Some people who have coverage "might find another unpleasant surprise: As many as half the nearly 7 million Americans who got subsidies to offset their premiums may have to refund money to the government, according to an estimate by H & R Block," the Journal reports. "The subsidies are based on consumers? own projections of their 2014 income, but some estimated incorrectly and received overly generous credits. Those people will see smaller-than-expected refunds or could owe the government money."

"H & R Block also found that as of Feb. 24, just over half of its clients with subsidized marketplace coverage had to repay a portion of their subsidy because their 2014 income turned out to be higher than what they estimated when they applied for coverage," the Times reports. "The process includes "new forms that even seasoned preparers are finding confusing."

The Obama administration announced last month that 800,000 people with insurance bought under the reform law had received incorrect information needed for their tax returns. About 10 percent of them have still not received corrected forms, it announced Friday. "The administration said people who have not received the corrected forms do not have to wait to file their taxes and will not have to pay any additional tax due to the effort," The Hill reports.

The Wall Street Journal reports, "Consumers who already filed their tax returns using the incorrect forms provided though state or federal exchanges won?t be required to file amended forms, and the Internal Revenue Service won?t assess additional taxes, said Mark Mazur, the Treasury Department?s assistant secretary for tax policy."

- 3,047 Got Private Health Insurance In Special March-april Signup Designed To Avoid Or Reduce Tax Penalty For Not Being Covered

More than 3,000 Kentuckians signed up for health coverage during a special March-April enrollment period that allowed them to avoid or reduce tax penalties for being uninsured. "At the Feb. 15 close of the 2015 open enrollment period, 158,685 individuals...

- Obamacare Deadline Is Extended For Those Who Had Technical Problems; State May Also Extend It For Those Facing A Tax Penalty

Were you unable to sign up for Kynect health insurance by the Sunday deadline because of technical problems? You now have until Feb. 28 to sign up. "And like other states and the federal government, Kentucky officials are also considering a 'special...

- Thousands Of Kentuckians Face Federal Tax Penalty For Not Having Health Insurance

"Thousands of Kentuckians might face a penalty this tax season for failing to sign up for health insurance during 2014," Mary Meehan reports for the Lexington Herald-Leader. The state estimated that 340,000 Kentuckians would buy private insurance through...

- Feb. 15 Is Deadline To Get Health Insurance; Those Who Don't Can Be Penalized Up To 2 Percent Of Their Annual Income

Sunday, Feb. 15 at 11:59 p.m. is the deadline to buy private, subsidized health insurance through Kynect, the state-run marketplace created under federal health reform. If your annual income is above the federal poverty level and you don't buy a policy...

- Penalty For Those Without Health Insurance In 2015 Will Be Significantly Higher Than For 2014; Feb. 15 Is Deadline To Sign Up

Wall Street Journal photo illustrationOne aspect of the Patient Protection and Affordable Care Act supporters don't spend much time talking about is the part of the law that imposes a penalty on those who don't have insurance, but the time has...