Health News

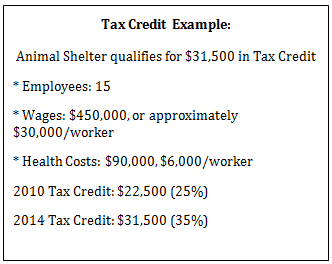

The ACA includes a provision that gives small employers, including nonprofits with fewer than 25 employees (with average salaries below $50,000), the right to access a tax credit for insurance premiums paid by the employer for their employees' health insurance. For tax-exempt nonprofits the credit is treated as a refund on quarterly payments that the nonprofit has made to the IRS for income tax withholdings or Medicare withholdings from employee wages. For 2010-2013 the refund is 25% of the expenses paid by the employer towards employees' health insurance premiums; the refund increases to 35% after January 1, 2014.[4] Non-profits should know that they are still able to retroactively apply for previous year?s tax credit if they meet all of the eligibility guidelines.

The ACA includes a provision that gives small employers, including nonprofits with fewer than 25 employees (with average salaries below $50,000), the right to access a tax credit for insurance premiums paid by the employer for their employees' health insurance. For tax-exempt nonprofits the credit is treated as a refund on quarterly payments that the nonprofit has made to the IRS for income tax withholdings or Medicare withholdings from employee wages. For 2010-2013 the refund is 25% of the expenses paid by the employer towards employees' health insurance premiums; the refund increases to 35% after January 1, 2014.[4] Non-profits should know that they are still able to retroactively apply for previous year?s tax credit if they meet all of the eligibility guidelines. The ACA offers two important tools to assist small employers ? the SHOP marketplace, and the small business tax credits. Together, these two strategies can help non-profits begin or continue to offer quality benefit programs at an affordable price. As nonprofit organizations continue to play an integral role in the workforce and in the communities they serve ? finding business partners that can assist in helping to leverage these resources will continue to be paramount for long term workforce and budgetary planning. Creating stability and financial sustainability in these areas will ultimately allow non-profits more freedom to focus on what?s important ? fulfilling the mission of their organization and continuing to serve the community around them.

The ACA offers two important tools to assist small employers ? the SHOP marketplace, and the small business tax credits. Together, these two strategies can help non-profits begin or continue to offer quality benefit programs at an affordable price. As nonprofit organizations continue to play an integral role in the workforce and in the communities they serve ? finding business partners that can assist in helping to leverage these resources will continue to be paramount for long term workforce and budgetary planning. Creating stability and financial sustainability in these areas will ultimately allow non-profits more freedom to focus on what?s important ? fulfilling the mission of their organization and continuing to serve the community around them.

Michele Thornton, MBA

Insurance & Benefits Consultant

- Illinois Small Businesses Should Shop For 2015 Health Coverage

Small business owners: are you considering all available options to find a health insurance plan that works best for your business and employees? One resource for Illinois small business owners is the Small Business Health Insurance Options Program, or...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- Illinois Granted Early Access To Shop Marketplace

Yes, the Affordable Care Act offers individuals and families quality health insurance, but did you know small employers with less than 50 full-time equivalent employees can take full advantage of the Health Insurance Marketplace? Online functionality...

- Getting Ready For The Affordable Care Act

Understanding the ways in which the Affordable Care Act (ACA) will affect small organizations and change the shape of the health care market isn't easy, especially with the large amount of misinformation that has been spread about the...

- Health Reform Will Help Small Businesses In Illinois

Did you know that almost 8 out of 10 small businesses in Illinois with 25 or fewer workers will receive financial relief because of the Affordable Care Act? If you want to see if your small business qualifies, check out the Small Business Majority's...

Health News

Can Non-Profits leverage the ACA to bring down health insurance costs?

The non-profit sector is a leading source of job growth in the United States and currently employs just under 11 million people nationally.[1] Locally here in Illinois, we see direct growth in this sector ? now holding 10.6% of the private employment, up from 9% in 2005.[2] However, in a recent survey of 600 national non-profit organizations, recent increases in employee turnover are indicated to be an ongoing concern.[3] One of the greatest tools that organizations have available to them to attract and retain high quality employees is the compensation and benefits package. Providing high value, yet affordable benefits is part of the ethos of most non-profit organizations. However, as the cost curve of health insurance continues to rise, this proposition has become increasingly more challenging. The Affordable Care Act created a small employer tax credit to help offset some of these costs ? but many non-profits are left wondering how this might benefit them.

To better understand the tax credit and available provisions under the ACA, you may want to explore the new small business page of Illinois Health Matters. Here you can find additional information about the small employer tax credit and other key resources.

Beginning in 2014, to obtain the tax credit ? employers must enroll in a qualified health plan through the SHOP Marketplace. These plans are competitively priced and cover all of the EssentialHealth Benefits that are important to you and the employees you are trying to retain. The Illinois SHOP Marketplace can be found at GetCoveredIllinois.gov. Here you can find additional information about the plans available ? but more importantly through their Get Help feature you can search for registered brokers in your neighborhood. Brokers can assist you in applying for the small employer tax credit, evaluate your health insurance and employee benefit package, and assist you in enrolling in a plan that qualifies for the tax credit reduction.

The ACA offers two important tools to assist small employers ? the SHOP marketplace, and the small business tax credits. Together, these two strategies can help non-profits begin or continue to offer quality benefit programs at an affordable price. As nonprofit organizations continue to play an integral role in the workforce and in the communities they serve ? finding business partners that can assist in helping to leverage these resources will continue to be paramount for long term workforce and budgetary planning. Creating stability and financial sustainability in these areas will ultimately allow non-profits more freedom to focus on what?s important ? fulfilling the mission of their organization and continuing to serve the community around them.

The ACA offers two important tools to assist small employers ? the SHOP marketplace, and the small business tax credits. Together, these two strategies can help non-profits begin or continue to offer quality benefit programs at an affordable price. As nonprofit organizations continue to play an integral role in the workforce and in the communities they serve ? finding business partners that can assist in helping to leverage these resources will continue to be paramount for long term workforce and budgetary planning. Creating stability and financial sustainability in these areas will ultimately allow non-profits more freedom to focus on what?s important ? fulfilling the mission of their organization and continuing to serve the community around them.Michele Thornton, MBA

Insurance & Benefits Consultant

[1] Salamon, LM, SW Sokolowski and SL Geller. Holding the Fort: Nonprofit employment during a decade of turmoil. Nonprofit Employment Bulletin 39, Johns Hopkins University. January 2012.

[2] Salamon, LM, SW Sokolowski and SL Geller. Illinois Nonprofit Employment: An Update. Nonprofit Employment Bulletin 21, Johns Hopkins University. January 2005.

[3] 2013 Nonprofit Employment Trends Survey Report. Nonprofit HR Solutions. Accessed at: http://www.nonprofithr.com/wp-content/uploads/2013/03/2013-Employment-Trends-Survey-Report.pdf

[4] Small Business Healthcare Tax Credit for Small Employers. IRS (2014). Accessed at: http://www.irs.gov/uac/Small-Business-Health-Care-Tax-Credit-for-Small-Employers

- Illinois Small Businesses Should Shop For 2015 Health Coverage

Small business owners: are you considering all available options to find a health insurance plan that works best for your business and employees? One resource for Illinois small business owners is the Small Business Health Insurance Options Program, or...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- Illinois Granted Early Access To Shop Marketplace

Yes, the Affordable Care Act offers individuals and families quality health insurance, but did you know small employers with less than 50 full-time equivalent employees can take full advantage of the Health Insurance Marketplace? Online functionality...

- Getting Ready For The Affordable Care Act

Understanding the ways in which the Affordable Care Act (ACA) will affect small organizations and change the shape of the health care market isn't easy, especially with the large amount of misinformation that has been spread about the...

- Health Reform Will Help Small Businesses In Illinois

Did you know that almost 8 out of 10 small businesses in Illinois with 25 or fewer workers will receive financial relief because of the Affordable Care Act? If you want to see if your small business qualifies, check out the Small Business Majority's...