Health News

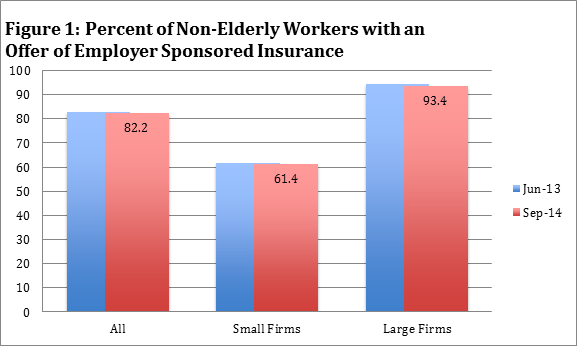

Rates of employer-sponsored healthcare have not declined since the implementation of the ACA, according to Fredric Blavin, a Senior Research Associate at the Urban Institute?s Health Policy Center. These findings, published in the January 2015 issue of Health Affairs, are based on his analysis of the Health Reform Monitoring Survey. Researchers at the Urban Institute administered this survey to workers between June 2013 and September 2014, asking if they are/were employed and if they are/were offered employer-sponsored health coverage. Analysis of these national data, displayed in figure 1, suggests that rates have remained statistically constant. The pre-existing and new ACA economic incentives for workers to obtain coverage from employers remains strong; the feared erosion has not yet materialized.

Rates of employer-sponsored healthcare have not declined since the implementation of the ACA, according to Fredric Blavin, a Senior Research Associate at the Urban Institute?s Health Policy Center. These findings, published in the January 2015 issue of Health Affairs, are based on his analysis of the Health Reform Monitoring Survey. Researchers at the Urban Institute administered this survey to workers between June 2013 and September 2014, asking if they are/were employed and if they are/were offered employer-sponsored health coverage. Analysis of these national data, displayed in figure 1, suggests that rates have remained statistically constant. The pre-existing and new ACA economic incentives for workers to obtain coverage from employers remains strong; the feared erosion has not yet materialized.

Massachusetts An Early Example

Earlier studies on Massachusetts? employer-sponsored insurance market support Blavin?s findings. Between fall 2006 and fall 2009, a period of time which included adoption of the state?s health reforms, the rate of employer-sponsored insurance increased by 3%.

ACA Provisions Prevented Downward Direction

Incentives in the healthcare law have restrained the predicted drop-off in employer coverage. Provisions, such as ongoing preferential tax treatment of premiums through payroll deductions and the mandate to provide coverage for businesses with 50 or more workers, have persuaded employers to continue offering plans.

But Small Firms Are Left Out

One notable result from this survey is the nagging imbalance between large firms and small firms offering coverage. Although mechanisms like the small employer tax credit and the SHOP Marketplace are meant to close this gap, small businesses have not taken advantage. Outreach and education with small businesses represents a large opportunity for insurance coverage expansion. Small employers need information to understand provisions of the ACA in order to provide health insurance options to this growing workforce.

Michele Thornton, MBA

Insurance and Benefits Consultant

- Illinois Small Businesses Should Shop For 2015 Health Coverage

Small business owners: are you considering all available options to find a health insurance plan that works best for your business and employees? One resource for Illinois small business owners is the Small Business Health Insurance Options Program, or...

- Small Businesses In Illinois Lack Knowledge Of What The Aca Has To Offer Them

With Illinois granted early access to the Small Business Health Options Program exchange, or SHOP, small businesses in the state already have the opportunity to familiarize themselves with a new online resource for purchasing health insurance for their...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- A Helping Hand For Small Businesses: Health Insurance Tax Credits

The Affordable Care Act (ACA) established a tax credit to help small businesses provide health insurance for their employees. According to a new study released today from Families USA and the Small Business Majority, 3.2 million small businesses, employing...

- Health Reform Will Help Small Businesses In Illinois

Did you know that almost 8 out of 10 small businesses in Illinois with 25 or fewer workers will receive financial relief because of the Affordable Care Act? If you want to see if your small business qualifies, check out the Small Business Majority's...

Health News

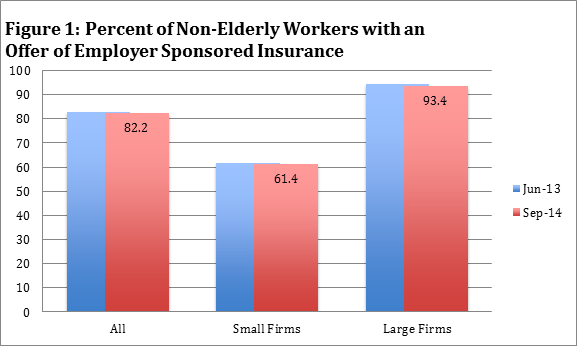

Employer-Sponsored Health Insurance Staying Steady

Rates of employer-sponsored healthcare have not declined since the implementation of the ACA, according to Fredric Blavin, a Senior Research Associate at the Urban Institute?s Health Policy Center. These findings, published in the January 2015 issue of Health Affairs, are based on his analysis of the Health Reform Monitoring Survey. Researchers at the Urban Institute administered this survey to workers between June 2013 and September 2014, asking if they are/were employed and if they are/were offered employer-sponsored health coverage. Analysis of these national data, displayed in figure 1, suggests that rates have remained statistically constant. The pre-existing and new ACA economic incentives for workers to obtain coverage from employers remains strong; the feared erosion has not yet materialized.

Rates of employer-sponsored healthcare have not declined since the implementation of the ACA, according to Fredric Blavin, a Senior Research Associate at the Urban Institute?s Health Policy Center. These findings, published in the January 2015 issue of Health Affairs, are based on his analysis of the Health Reform Monitoring Survey. Researchers at the Urban Institute administered this survey to workers between June 2013 and September 2014, asking if they are/were employed and if they are/were offered employer-sponsored health coverage. Analysis of these national data, displayed in figure 1, suggests that rates have remained statistically constant. The pre-existing and new ACA economic incentives for workers to obtain coverage from employers remains strong; the feared erosion has not yet materialized.

Massachusetts An Early Example

Earlier studies on Massachusetts? employer-sponsored insurance market support Blavin?s findings. Between fall 2006 and fall 2009, a period of time which included adoption of the state?s health reforms, the rate of employer-sponsored insurance increased by 3%.

ACA Provisions Prevented Downward Direction

Incentives in the healthcare law have restrained the predicted drop-off in employer coverage. Provisions, such as ongoing preferential tax treatment of premiums through payroll deductions and the mandate to provide coverage for businesses with 50 or more workers, have persuaded employers to continue offering plans.

But Small Firms Are Left Out

One notable result from this survey is the nagging imbalance between large firms and small firms offering coverage. Although mechanisms like the small employer tax credit and the SHOP Marketplace are meant to close this gap, small businesses have not taken advantage. Outreach and education with small businesses represents a large opportunity for insurance coverage expansion. Small employers need information to understand provisions of the ACA in order to provide health insurance options to this growing workforce.

Michele Thornton, MBA

Insurance and Benefits Consultant

- Illinois Small Businesses Should Shop For 2015 Health Coverage

Small business owners: are you considering all available options to find a health insurance plan that works best for your business and employees? One resource for Illinois small business owners is the Small Business Health Insurance Options Program, or...

- Small Businesses In Illinois Lack Knowledge Of What The Aca Has To Offer Them

With Illinois granted early access to the Small Business Health Options Program exchange, or SHOP, small businesses in the state already have the opportunity to familiarize themselves with a new online resource for purchasing health insurance for their...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- A Helping Hand For Small Businesses: Health Insurance Tax Credits

The Affordable Care Act (ACA) established a tax credit to help small businesses provide health insurance for their employees. According to a new study released today from Families USA and the Small Business Majority, 3.2 million small businesses, employing...

- Health Reform Will Help Small Businesses In Illinois

Did you know that almost 8 out of 10 small businesses in Illinois with 25 or fewer workers will receive financial relief because of the Affordable Care Act? If you want to see if your small business qualifies, check out the Small Business Majority's...