Health News

Looking ahead to 2015, many employers are deciding how to respond to the rising cost of employee group health insurance premiums. A study of employers by the large consulting group Mercer suggests that ?the per-employee health benefit cost will rise by an average of 3.9% in 2015.? Although this is moderate compared to past premium-increase trends, ?two-thirds of respondents say they will make changes to their health plans next year to rein in cost growth.?

Looking ahead to 2015, many employers are deciding how to respond to the rising cost of employee group health insurance premiums. A study of employers by the large consulting group Mercer suggests that ?the per-employee health benefit cost will rise by an average of 3.9% in 2015.? Although this is moderate compared to past premium-increase trends, ?two-thirds of respondents say they will make changes to their health plans next year to rein in cost growth.?

To control costs, some small employers are considering dropping group coverage altogether. In a recent article by the Wall Street Journal, WellPoint, Inc. reported that ?its small-business-plan membership is shrinking faster than expected and it has lost about 300,000 people.?

Many small employers are instead planning to offer a cash payout ? a lump-sum of cash ? for employees to purchase coverage on their own or through the new ACA marketplaces. While this may appear an attractive way to rein in health insurance costs, employers must consider the tax implications for employees and their organization. Taken together, cash pay-outs will actually increase costs overall for both employers and employees.

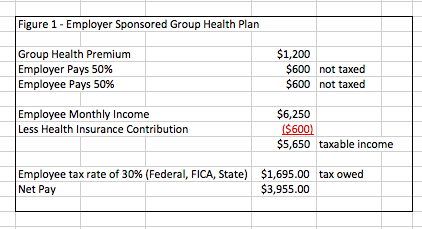

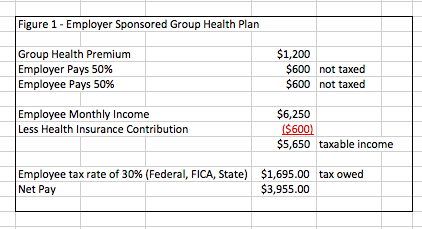

Group insurance is a better deal for employees. With group health insurance, the amount that an employer pays towards an employee?s health insurance is not counted as taxable income. In addition, employee premium contributions can be withdrawn pre-tax directly from their paycheck. This substantially reduces the employee?s overall taxable income and the income tax they will pay. The example below shows the monthly take-home pay for a person making $6,250 per month who participates in an employer-sponsored group health plan.

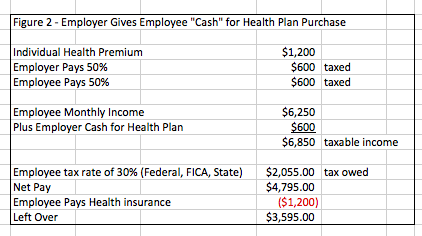

As the example indicates, the employee?s net pay is $3,955. In comparison, if the same employee instead received a cash pay-out to purchase health insurance individually, they would make $3,595 per month. Example 2 shows how employees will end up paying more in taxes and more for their insurance when a cash pay-out is used.

Because cash pay-outs increase employee gross income, the amount that the employer must pay in state and federal taxes will also increase. In our example above, when the employer offered group health insurance, the employee earned a base monthly salary of $5,650. In the second scenario, the employee?s monthly salary increased to $6,850. Employers pay on average 7.65% of their monthly payroll for Social Security and Medicare. For the employer providing group health insurance, the cost for Social Security and Medicare is $432; the employer offering cash instead of benefits would pay $524. This results in a difference to the employer of $92 per month ? just for this one employee.

Higher salaries created by cash pay-outs also mean higher workers compensation costs, and short-term and long-term disability insurance. Since workers? compensation replaces a portion of the employee?s salary, the higher the salary, the higher the costs. The same is true for short- and long-term disability insurance, which replaces all or part of employee salaries.

Before quickly migrating to cash payouts employers should quantify cost implications for themselves and their employees. This calculation can complicate and lengthen the decision making process ? but it is time well spent in the long run. If the goal is to reduce financial burden, using cash pay-outs ultimately creates the opposite effect and the promised reduction in costs is an illusion.

Michele Thornton, MBA

Insurance and Benefits Consultant

- Study Finds That Obese Workers Cost Employers Thousands In Extra Medical Costs Every Year; Kentucky Ranks Ninth In Obesity

A morbidly obese employee costs his or her employer approximately $4,000 more in health care and related costs every year than an employee of normal weight, according to a study in the American Journal of Health Promotion. Kentucky ranks ninth...

- Survey Finds Employees Pay Greater Share Of Health Costs, And Most Large Employers Penalize Them For Using Tobacco

As large employers respond to changes influenced by health care reform and rising costs of care, employees are paying a greater portion of their health-care costs. That trend that is likely to continue over the next few years, says a new report on employer-based...

- Annual Report For Cincinnati-northern Kentucky Region Shows Employee Health Care Costs There Will Go Up About $400 Next Year

In an continuing effort to move health costs off the shoulders of employers and onto employees, workers in Greater Cincinnati and Northern Kentucky will likely pay an average $4,775 out of their own pockets for health care in 2013 -- about $400 more than...

- Small Employers: Take Another Look At Wellness Programs

Small employers want a healthy workforce but wonder how and if they should promote healthy behaviors among their employees. Trends show that larger employers, who typically self-fund their health insurance programs, find a direct link between the...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

Health News

Employers: Dropping Group Health Insurance Could Cost You

Looking ahead to 2015, many employers are deciding how to respond to the rising cost of employee group health insurance premiums. A study of employers by the large consulting group Mercer suggests that ?the per-employee health benefit cost will rise by an average of 3.9% in 2015.? Although this is moderate compared to past premium-increase trends, ?two-thirds of respondents say they will make changes to their health plans next year to rein in cost growth.?

Looking ahead to 2015, many employers are deciding how to respond to the rising cost of employee group health insurance premiums. A study of employers by the large consulting group Mercer suggests that ?the per-employee health benefit cost will rise by an average of 3.9% in 2015.? Although this is moderate compared to past premium-increase trends, ?two-thirds of respondents say they will make changes to their health plans next year to rein in cost growth.?Using Cash Pay-Outs Instead

Many small employers are instead planning to offer a cash payout ? a lump-sum of cash ? for employees to purchase coverage on their own or through the new ACA marketplaces. While this may appear an attractive way to rein in health insurance costs, employers must consider the tax implications for employees and their organization. Taken together, cash pay-outs will actually increase costs overall for both employers and employees.

Employees Will Pay More...

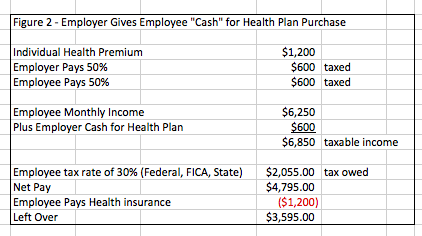

As the example indicates, the employee?s net pay is $3,955. In comparison, if the same employee instead received a cash pay-out to purchase health insurance individually, they would make $3,595 per month. Example 2 shows how employees will end up paying more in taxes and more for their insurance when a cash pay-out is used.

As you can see, cash pay-outs will reduce overall employee compensation. When employees give workers cash to pay for their own health insurance, the money increases their gross income and in effect the monthly taxes they must pay. Additionally, the money directed toward employee premiums cannot be withdrawn pre-tax from their paycheck.

The real numbers will change depending on premium costs, tax brackets, and income level, but the message is consistent: employees will lose money. Employee Benefits Corporation has a great calculator tool that helps individuals understand the personal impact of pre-tax benefits.

... And So Will Employers

Higher salaries created by cash pay-outs also mean higher workers compensation costs, and short-term and long-term disability insurance. Since workers? compensation replaces a portion of the employee?s salary, the higher the salary, the higher the costs. The same is true for short- and long-term disability insurance, which replaces all or part of employee salaries.

Stick With Group Health Insurance

Michele Thornton, MBA

Insurance and Benefits Consultant

- Study Finds That Obese Workers Cost Employers Thousands In Extra Medical Costs Every Year; Kentucky Ranks Ninth In Obesity

A morbidly obese employee costs his or her employer approximately $4,000 more in health care and related costs every year than an employee of normal weight, according to a study in the American Journal of Health Promotion. Kentucky ranks ninth...

- Survey Finds Employees Pay Greater Share Of Health Costs, And Most Large Employers Penalize Them For Using Tobacco

As large employers respond to changes influenced by health care reform and rising costs of care, employees are paying a greater portion of their health-care costs. That trend that is likely to continue over the next few years, says a new report on employer-based...

- Annual Report For Cincinnati-northern Kentucky Region Shows Employee Health Care Costs There Will Go Up About $400 Next Year

In an continuing effort to move health costs off the shoulders of employers and onto employees, workers in Greater Cincinnati and Northern Kentucky will likely pay an average $4,775 out of their own pockets for health care in 2013 -- about $400 more than...

- Small Employers: Take Another Look At Wellness Programs

Small employers want a healthy workforce but wonder how and if they should promote healthy behaviors among their employees. Trends show that larger employers, who typically self-fund their health insurance programs, find a direct link between the...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...