Health News

1. Uninsured don't know they must get health coverage or pay a tax penalty

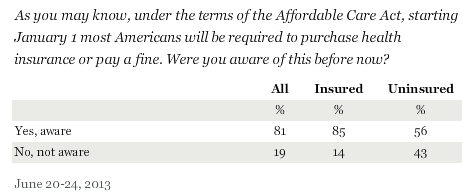

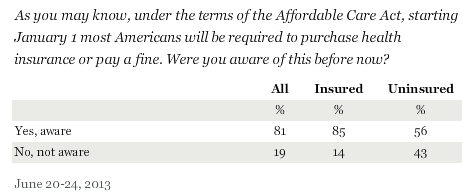

Many people know about Obamacare, but a large percentage of the uninsured do not know that they will soon be required to buy coverage, according to the most recent Gallup poll:

2. Middle-class and low-income Americans don't know about subsidies

Another part of the Obamacare message that hasn't yet gotten through to millions of Americans, at least those who need to know, is that the law offers subsidies for coverage, based on income. The challenge is that this message must get to a hard-to-reach population without inflating the law's benefits, Millman and Kenan write. And, many of those who qualify for Medicaid or subsidized coverage are low-income, may not speak English well, or may know little about health insurance.

On top of these obstacles, there can't be a consistent, nationwide message because the coverage criteria is different for states like Kentucky that aren't using a federal health insurance exchange. Kentuckians can visit the exchange website, Kynect, to see if they qualify for special discounts or tax credits to help cover the costs of coverage. For example, the website indicates that a family of four making $48,000 a year will get an estimated $252-per-month tax credit for buying insurance. For a PDF fact sheet about payment assistance, click here.

3. Appealing to young invincibles and businesses

For the new system to work, it is critical that young, healthy people buy insurance to cover the cost of care for older and sicker individuals and keep overall premium costs down. Many young people don't know what an insurance premium or co-payment is, and many don't think they need health coverage. Still, Obama administration officials have said they?re hoping 7 million people sign up for private insurance through exchanges in the first year, including 2.7 million young adults.

The delay in the employer mandate came as a relief to many employers who say it will put their businesses at the brink of survival. But the requirement has only been delayed to 2015, not repealed. Before the delay, some companies with payrolls slightly above or below the 50-employee threshold said they would cut or keep their number of full-time workers below that figure to avoid providing coverage.

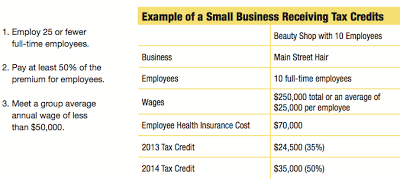

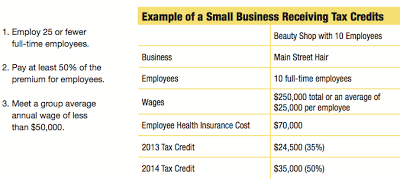

Many businesses with 50 or fewer employees don't know they won't be penalized for not offering health coverage and that they can get tax credits for providing it. Kentucky businesses can use Kynect to buy coverage if they have 50 or fewer employees. Significant tax credits may be available through the site for businesses that have fewer than 25 employees with an average annual salary under $50,000; the employer must pay at least 50 percent of the premium for each employee. See the chart below or click here for more details.

4. Threats to public messaging campaigns from the opposition

While the success of Obamacare may depend upon public awareness and outreach efforts, the efforts of those opposing it create additional challenges for supporters. Many Republicans used the delay announcement to advance the cause of overall repeal or delay of the individual mandate. House Speaker John Boehner said, ?I hope the administration recognizes the need to release American families from the mandates of this law as well. This is a clear acknowledgment that the law is unworkable.?

Senate Republican Leader Mitch McConnell of Kentucky said, ?The White House seems to slowly be admitting what Americans already know, and what I hear consistently in my travels around Kentucky regarding the regulatory burden on employers.?

On the other hand, former White House health policy adviser Ezekiel Emanuel said on MSNBC?s "Morning Joe" that the delay of the employer mandate will affect a relatively small number of companies and is no big deal. The provision only applies to about 200,000 employers who have 50 or more employees working full-time (which the law defines as 30 hours or more a week), he said, and ?94 percent already offer health insurance.?

- Here Are Tools And Resources To Help You Understand How The Health Reform Law Impacts You, Your Family And Your Business

By Molly Burchett Kentucky Health News The rollout of the insurance-buying section of the Patient Protection Affordable Care Act started Oct. 1, and regardless of where you stand on the law, it's important to be informed about what will happen Jan....

- Mcconnell Calls For One-year Delay In Reform Law's Key Requirement, That Americans Buy Health Insurance

U.S. Sen. Mitch McConnellU.S. Sen. Mitch McConnell is calling for a one-year delay in the requirement for almost all Americans to buy health insurance, followed by repeal of the federal health-reform law. The Obama administration has said it will delay...

- Beshear Announces Launch Of Kynect, The State's New Online Shop For Health Insurance; Open Enrollment Starts Oct. 1

Gov. Steve Beshear has announced the launch of Kentucky?s Healthcare Connection, which is referred to as Kynect and is Kentucky's one-stop onlineshop for the state's new health insurance exchange. Beginning next year, most Americans will be required...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- A Helping Hand For Small Businesses: Health Insurance Tax Credits

The Affordable Care Act (ACA) established a tax credit to help small businesses provide health insurance for their employees. According to a new study released today from Families USA and the Small Business Majority, 3.2 million small businesses, employing...

Health News

Employers welcome delay in coverage mandate, but individual mandate remains and many uninsured people are unaware of it

By Molly Burchett

The Obama administration's decision to delay, for a year, the health-reform law's mandate that employers of more than 50 workers offer them coverage could jeopardize the success of the law -- which already faced several challenges.

The linchpin holding the wheels of "Obamacare" together is an individual mandate, which remains in effect. Millions of people must sign up for insurance coverage -- especially those who are healthy. About 50 million, including 640,000 Kentuckians, who haven't bought or been able to buy health insurance will have to do so or pay a tax penalty, unless they qualify for the expanded Medicaid program.

The delay in the employer mandate could reduce the number of uninsured people who will use state-based insurance exchanges to shop for insurance coverage starting Oct. 1, said Sara Rosenbaum, a professor of health law and policy at George Washington University and an advocate of the law. A White House spokeswoman disputed that, but Obama and his allies face four other broad challenges in implementing the law, as outlined in a recent Politico story by Jason Millman and Joanne Kenen:

Kentucky Health News

The linchpin holding the wheels of "Obamacare" together is an individual mandate, which remains in effect. Millions of people must sign up for insurance coverage -- especially those who are healthy. About 50 million, including 640,000 Kentuckians, who haven't bought or been able to buy health insurance will have to do so or pay a tax penalty, unless they qualify for the expanded Medicaid program.

The delay in the employer mandate could reduce the number of uninsured people who will use state-based insurance exchanges to shop for insurance coverage starting Oct. 1, said Sara Rosenbaum, a professor of health law and policy at George Washington University and an advocate of the law. A White House spokeswoman disputed that, but Obama and his allies face four other broad challenges in implementing the law, as outlined in a recent Politico story by Jason Millman and Joanne Kenen:

1. Uninsured don't know they must get health coverage or pay a tax penalty

Many people know about Obamacare, but a large percentage of the uninsured do not know that they will soon be required to buy coverage, according to the most recent Gallup poll:

2. Middle-class and low-income Americans don't know about subsidies

Another part of the Obamacare message that hasn't yet gotten through to millions of Americans, at least those who need to know, is that the law offers subsidies for coverage, based on income. The challenge is that this message must get to a hard-to-reach population without inflating the law's benefits, Millman and Kenan write. And, many of those who qualify for Medicaid or subsidized coverage are low-income, may not speak English well, or may know little about health insurance.

On top of these obstacles, there can't be a consistent, nationwide message because the coverage criteria is different for states like Kentucky that aren't using a federal health insurance exchange. Kentuckians can visit the exchange website, Kynect, to see if they qualify for special discounts or tax credits to help cover the costs of coverage. For example, the website indicates that a family of four making $48,000 a year will get an estimated $252-per-month tax credit for buying insurance. For a PDF fact sheet about payment assistance, click here.

3. Appealing to young invincibles and businesses

For the new system to work, it is critical that young, healthy people buy insurance to cover the cost of care for older and sicker individuals and keep overall premium costs down. Many young people don't know what an insurance premium or co-payment is, and many don't think they need health coverage. Still, Obama administration officials have said they?re hoping 7 million people sign up for private insurance through exchanges in the first year, including 2.7 million young adults.

The delay in the employer mandate came as a relief to many employers who say it will put their businesses at the brink of survival. But the requirement has only been delayed to 2015, not repealed. Before the delay, some companies with payrolls slightly above or below the 50-employee threshold said they would cut or keep their number of full-time workers below that figure to avoid providing coverage.

Many businesses with 50 or fewer employees don't know they won't be penalized for not offering health coverage and that they can get tax credits for providing it. Kentucky businesses can use Kynect to buy coverage if they have 50 or fewer employees. Significant tax credits may be available through the site for businesses that have fewer than 25 employees with an average annual salary under $50,000; the employer must pay at least 50 percent of the premium for each employee. See the chart below or click here for more details.

4. Threats to public messaging campaigns from the opposition

While the success of Obamacare may depend upon public awareness and outreach efforts, the efforts of those opposing it create additional challenges for supporters. Many Republicans used the delay announcement to advance the cause of overall repeal or delay of the individual mandate. House Speaker John Boehner said, ?I hope the administration recognizes the need to release American families from the mandates of this law as well. This is a clear acknowledgment that the law is unworkable.?

Senate Republican Leader Mitch McConnell of Kentucky said, ?The White House seems to slowly be admitting what Americans already know, and what I hear consistently in my travels around Kentucky regarding the regulatory burden on employers.?

On the other hand, former White House health policy adviser Ezekiel Emanuel said on MSNBC?s "Morning Joe" that the delay of the employer mandate will affect a relatively small number of companies and is no big deal. The provision only applies to about 200,000 employers who have 50 or more employees working full-time (which the law defines as 30 hours or more a week), he said, and ?94 percent already offer health insurance.?

- Here Are Tools And Resources To Help You Understand How The Health Reform Law Impacts You, Your Family And Your Business

By Molly Burchett Kentucky Health News The rollout of the insurance-buying section of the Patient Protection Affordable Care Act started Oct. 1, and regardless of where you stand on the law, it's important to be informed about what will happen Jan....

- Mcconnell Calls For One-year Delay In Reform Law's Key Requirement, That Americans Buy Health Insurance

U.S. Sen. Mitch McConnellU.S. Sen. Mitch McConnell is calling for a one-year delay in the requirement for almost all Americans to buy health insurance, followed by repeal of the federal health-reform law. The Obama administration has said it will delay...

- Beshear Announces Launch Of Kynect, The State's New Online Shop For Health Insurance; Open Enrollment Starts Oct. 1

Gov. Steve Beshear has announced the launch of Kentucky?s Healthcare Connection, which is referred to as Kynect and is Kentucky's one-stop onlineshop for the state's new health insurance exchange. Beginning next year, most Americans will be required...

- Illinois Entrepreneurs And Small Business Need Shop Employee Choice

Illinois is one of 18 states recently granted a delay by the Department of Health and Human Services for the employee choice feature of the small business health options program marketplace, or SHOP. But what exactly is employee choice, and why is this...

- A Helping Hand For Small Businesses: Health Insurance Tax Credits

The Affordable Care Act (ACA) established a tax credit to help small businesses provide health insurance for their employees. According to a new study released today from Families USA and the Small Business Majority, 3.2 million small businesses, employing...