Health News

- Not Only May You Not Get To Keep Your Plan Under Obamacare, You Might Not Be Able To Keep Your Doctor; There Are Reasons

By Molly Burchett Kentucky Health News Part of the sales pitch for the federal health-care reform law was that people could keep their doctors, but many Americans and some Kentuckians won't because insurers are excluding some hospitals and doctors...

- At Least One Insurance Company Will Let Kentuckians Keep Their Health Insurance Plan For Another Year If They Like It

By Molly Burchett Kentucky Health News At least one insurance company, Humana, will be allowing Kentuckians to keep their insurance coverage for another year if they like it, even if the policies aren't compliant with the Patient Protection and Affordable...

- Beware Of Identity Thieves Exploiting The Patient Protection And Affordable Care Act To Get Personal Information

As if buying health insurance isn't confusing enough, the Better Business Bureau has sent out a series of releases warning people to beware of scam artists posing as callers claiming to be from the federal government. The scam is mostly targeting...

- Beshear Announces Launch Of Kynect, The State's New Online Shop For Health Insurance; Open Enrollment Starts Oct. 1

Gov. Steve Beshear has announced the launch of Kentucky?s Healthcare Connection, which is referred to as Kynect and is Kentucky's one-stop onlineshop for the state's new health insurance exchange. Beginning next year, most Americans will be required...

- Clearing Up The Facts

There has been a lot of confusion about some recent notices to consumers from insurance companies that sell coverage in the individual insurance market, and I?d like to clear up the facts. Today, more than 3 out of every 4 Americans get insurance from...

Health News

Health insurers could exclude one in four Americans from coverage because they don't have bank accounts

By Molly Burchett

Kentucky Health News

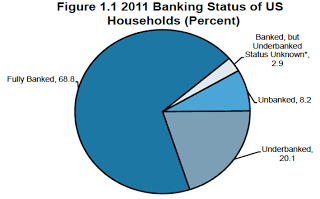

A new study says if corrective action isn't taken, health-insurance companies could exclude 27 percent of qualifying Americans now eligible for premium-assistance tax credits under the health-reform law because they plan to require customers to pay premiums automatically through a bank account. More than 1 in 4 of these people do not have a bank account.

If insurance companies won't do business with them, that will undermine efforts to expand health coverage and equalize access to health care, denying coverage to the more than 8 million "unbanked" Americans, says the report from tax firm Jackson Hewitt.

Unbanked households are those that lack any kind of deposit account, checking or savings, at an insured depository institution, so requiring a checking account for coverage could also worsen the existing disparities in both health-care access and health status of minority groups. African Americans and Hispanics are over 40 percent more likely than whites to be "unbanked," says the report.

Most health plans accept a credit card for the first month?s premium payment and thereafter require monthly payment from a checking account. An estimated 30 percent of U.S. households are "unbanked" or underbanked, with the highest rates among non-Asian minorities and lower-income, younger and unemployed households; underbanked households hold a bank account but also rely on alternative financial services, and one in five households use such check-cashing stores and money lenders instead of a traditional bank, says the Federal Deposit Insurance Corp.

This all goes against the basic ideals behind the health care law's "comprehensive reforms that improve access to affordable health coverage for everyone and protect consumers from abusive insurance company practices. The law allows all Americans to make health insurance choices that work for them while guaranteeing access to care for our most vulnerable, and provides new ways to bring down costs and improve quality of care," says the White House website.

Law doesn't protect Americans from discrimination

Federal officials are wary taking action that may discourage insurance companies from participating in the exchanges, current and former state health officers who have pressed the U.S Department of Health and Human Services for a ruling told Varney.

?I think there is a dawning awareness that this is a large problem,? Brian Haile told Varney; Haile is senior vice president for health policy at Jackson Hewitt Tax Service and has called on federal official to set a uniform standard requiring all insurers to accept all forms of payment.

Neither the health law nor other laws require insurance companies to accept all forms of payment, says Sarah Varney of Kaiser Health News. Alternative forms of payment include credit cards or pre-paid debit cards that people without bank accounts often use, and although health insurance companies are evaluating these options, they are not required to do so, reports Varney.

?I?ve not seen any specific guidance that says you have to be able to accept these types of payments,? Ray Smithberger, Cigna?s general manager of individual and family plans, told Sarah Kliff of The Washington Post.

Insurance carriers take a risk by accepting credit cards and pre-paid debit cards because transaction fees can run as high as 4 percent and pre-paid cards are popular among low-wage workers, Haile told Varney.

?If you accept re-loadable debit cards, are you in fact getting folks with lower health status?? Haile told Varney. ?That?s a real risk when you?re in the insurance business. So you can?t be the only one picking up those risks.?

The Jackson Hewitt report calls for immediate action by federal policy makers to ensure insurers cannot discriminate against the 'unbanked' through their payment acceptance policies by creating a system-wide rule requiring all forms of payment must be accepted.

"Given the dilemma presented to insurance companies by the strong financial incentives to discourage non-bank payment mechanisms, insurers are unlikely to resolve this issue without federal action," says the report.

Kentucky Health News

|

| Federal Deposit Insurance Corp. graphic |

If insurance companies won't do business with them, that will undermine efforts to expand health coverage and equalize access to health care, denying coverage to the more than 8 million "unbanked" Americans, says the report from tax firm Jackson Hewitt.

Unbanked households are those that lack any kind of deposit account, checking or savings, at an insured depository institution, so requiring a checking account for coverage could also worsen the existing disparities in both health-care access and health status of minority groups. African Americans and Hispanics are over 40 percent more likely than whites to be "unbanked," says the report.

This all goes against the basic ideals behind the health care law's "comprehensive reforms that improve access to affordable health coverage for everyone and protect consumers from abusive insurance company practices. The law allows all Americans to make health insurance choices that work for them while guaranteeing access to care for our most vulnerable, and provides new ways to bring down costs and improve quality of care," says the White House website.

Law doesn't protect Americans from discrimination

Federal officials are wary taking action that may discourage insurance companies from participating in the exchanges, current and former state health officers who have pressed the U.S Department of Health and Human Services for a ruling told Varney.

?I think there is a dawning awareness that this is a large problem,? Brian Haile told Varney; Haile is senior vice president for health policy at Jackson Hewitt Tax Service and has called on federal official to set a uniform standard requiring all insurers to accept all forms of payment.

Neither the health law nor other laws require insurance companies to accept all forms of payment, says Sarah Varney of Kaiser Health News. Alternative forms of payment include credit cards or pre-paid debit cards that people without bank accounts often use, and although health insurance companies are evaluating these options, they are not required to do so, reports Varney.

?I?ve not seen any specific guidance that says you have to be able to accept these types of payments,? Ray Smithberger, Cigna?s general manager of individual and family plans, told Sarah Kliff of The Washington Post.

Insurance carriers take a risk by accepting credit cards and pre-paid debit cards because transaction fees can run as high as 4 percent and pre-paid cards are popular among low-wage workers, Haile told Varney.

?If you accept re-loadable debit cards, are you in fact getting folks with lower health status?? Haile told Varney. ?That?s a real risk when you?re in the insurance business. So you can?t be the only one picking up those risks.?

The Jackson Hewitt report calls for immediate action by federal policy makers to ensure insurers cannot discriminate against the 'unbanked' through their payment acceptance policies by creating a system-wide rule requiring all forms of payment must be accepted.

"Given the dilemma presented to insurance companies by the strong financial incentives to discourage non-bank payment mechanisms, insurers are unlikely to resolve this issue without federal action," says the report.

- Not Only May You Not Get To Keep Your Plan Under Obamacare, You Might Not Be Able To Keep Your Doctor; There Are Reasons

By Molly Burchett Kentucky Health News Part of the sales pitch for the federal health-care reform law was that people could keep their doctors, but many Americans and some Kentuckians won't because insurers are excluding some hospitals and doctors...

- At Least One Insurance Company Will Let Kentuckians Keep Their Health Insurance Plan For Another Year If They Like It

By Molly Burchett Kentucky Health News At least one insurance company, Humana, will be allowing Kentuckians to keep their insurance coverage for another year if they like it, even if the policies aren't compliant with the Patient Protection and Affordable...

- Beware Of Identity Thieves Exploiting The Patient Protection And Affordable Care Act To Get Personal Information

As if buying health insurance isn't confusing enough, the Better Business Bureau has sent out a series of releases warning people to beware of scam artists posing as callers claiming to be from the federal government. The scam is mostly targeting...

- Beshear Announces Launch Of Kynect, The State's New Online Shop For Health Insurance; Open Enrollment Starts Oct. 1

Gov. Steve Beshear has announced the launch of Kentucky?s Healthcare Connection, which is referred to as Kynect and is Kentucky's one-stop onlineshop for the state's new health insurance exchange. Beginning next year, most Americans will be required...

- Clearing Up The Facts

There has been a lot of confusion about some recent notices to consumers from insurance companies that sell coverage in the individual insurance market, and I?d like to clear up the facts. Today, more than 3 out of every 4 Americans get insurance from...