Health News

- Merger Mania: Aetna Bids For Humana; Cigna May Want It Too; Anthem Has Bid For Cigna; Unitedhealth Makes A Play For Aetna

Aetna Inc. has made a bid to buy Louisville-based Humana Inc.,"one of a number of recent moves by big health insurers to find merger partners," Dana Mattioli and Liz Hoffman report for The Wall Street Journal. The proposal was made in "the last few days,"...

- Humana Inc. Bus Travels The Rural Roads Of Mississippi, Looking To Enroll People In Obamacare By March 31 Deadline

Insurance providers have been scared off by Mississippi, one of the poorest and unhealthiest states in the country. Only nine percent of eligible residents have signed up for insurance under federal health reform, ranking Mississippi near the bottom of...

- At Least One Insurance Company Will Let Kentuckians Keep Their Health Insurance Plan For Another Year If They Like It

By Molly Burchett Kentucky Health News At least one insurance company, Humana, will be allowing Kentuckians to keep their insurance coverage for another year if they like it, even if the policies aren't compliant with the Patient Protection and Affordable...

- Aetna Buying Coventry, Which Manages Some Medicaid Care

Aetna will buy Coventry Health Care for about $5.6 billion as the third-largest health insurance company poises itself for more Medicare and Medicaid patients under the federal health-care reform law. Coventry Cares is one of four managed care organizations...

- Humana Reinvents Itself Again, To Adapt To U.s. Health-care Reform

Humana, Kentucky's largest corporation, says it is reinventing itself in the wake of the federal health reform law, focusing on becoming a "well-being" company rather than just a provider of health insurance. Of the notable changes, the Louisville-based...

Health News

Politicians, economists and journalists debate the reasons for, and the impact of, proposed sale of Humana to Aetna

By Al Cross

Kentucky Health News

The purchase of Louisville-based Humana Inc. by fellow health-insurance giant Aetna Inc. for $37 billion still needs approval from federal anti-trust officials, partly because of the possibility that the merger will reduce competition and increase premiums.

Even before the deal was announced, Senate Majority Leader Mitch McConnell, R-Ky., said Thursday, "You?ve seen the rumors about Humana being gobbled up by someone who?s even bigger. This kind of government takeover of the private health-insurance market ? think of it this way: what Obamacare has basically done is taken the private health insurance market and turned it almost into a regulated utility."

In a press release Friday, McConnell said, "This morning?s announcement, as I predicted during the debate five years ago, is the inevitable result of Obamacare?s push toward consolidation as doctors, hospitals, and insurers merge in response to an ever-growing government."

Humana has 12,500 employees and 1,500 contractors in the Louisville area. Fischer said, "I think it's very fair to speculate that it will lead to more jobs," and Bruce Broussard, president and CEO of Humana, said, "I think Louisville will be a net beneficiary as a result of this transaction."

However, University of Louisville finance professor David Dubofsky "said it may not turn out so well for the Louisville and Humana employees after all," The Courier-Journal reports, quoting him: "When two companies in the same industry merge, and the acquirer is paying a premium, you have to generate cost savings," partly by reducing employment among workers with similar jobs.

There is a connection between the merger of health-care providers, such as the creation of Kentucky One Health by several hospital groups, and the merger of insurance companies. "Many experts have said that the provider consolidation can drive higher rates?and that more-powerful insurers might have a better chance of countering them and striking pacts for new forms of payment that incentivize efficiency," Anna Wilde Matthews and Christopher Weaver write for The Wall Street Journal.

But they also note, "Research suggests that having fewer insurers leads to higher premiums, said Leemore S. Dafny, a former Federal Trade Commission official who is a professor at Northwestern University?s Kellogg School of Management.

Aetna with Humana would dominate the Medicare Advantage market in some states, with 90 percent of it in Kansas, notes Drew Altman, president of the Kaiser Family Foundation. "Of course, regulators could insist that companies take steps to maintain more competitive markets."

The Journal reports that it analyzed a Medicare database and found, "An Aetna-Humana tie-up would increase by about 180 the number of U.S. counties where at least 75 percent of customers for Medicare Advantage plans are in the hands of a single insurer." Most of those counties are in the South and Midwest. Using another federal database, it found that "In eight states, an Aetna-Humana merger would remove a competitor from the exchanges where individuals can buy coverage under the Affordable Care Act."

The prospect that jobs might be lost in Louisville doesn't mean that the ACA has put financial pressure on Aetna or Humana, Dan Diamond writes for Forbes magazine: "There?s limited evidence that the biggest players are struggling. While the ACA capped insurers? ability to take profits, industry analysts have been fairly bullish on the sector. . . . And as I wrote earlier this week, the ACA appears to have only helped major insurers, by driving millions of new customers into the market. Aetna and Humana have seen their stock valuations triple in the past five years, since the ACA was signed into law, and the other three major insurers also have seen huge gains."

Diamond also isn't buying the argument, advanced by Aetna officials, that the combined company will be more efficient than the separate ones. "Aetna and Humana already are giant, scaled entities," he notes. "And economists aren?t buying the claim that insurer consolidation will lead to lower costs." As Judy Woodruff noted on "PBS Newshour" Friday, the deal would give the combined company more leverage to negotiate payments to health-care providers.

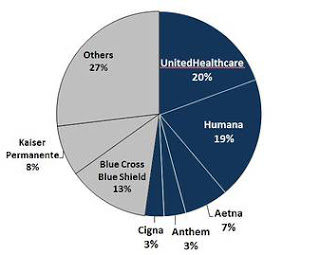

Diamond says the best case for Aetna's purchase is that it gets the company deeply into the Medicare Advantage business, without having to expend "a great deal of work and time," as Michael Bernstein, a partner at Baird Capital partner who focuses on health care, told Bloomberg News last month. Aetna has only 7 percent of that business, Humana 19 percent -- and about 65 percent of its revenues came from Medicare Advantage plans in 2014, Altman notes. The combined company is expected to get 56 percent of its revenue from government programs.

Diamond says economists see one more possible reason for the merger: "Amid health care?s merger mania, insurers are feeling psychological pressure to make deals of their own." And that does take us back to Obamacare. But the impact on Kentucky has yet to be seen, and so do the reasons.

Kentucky Health News

The purchase of Louisville-based Humana Inc. by fellow health-insurance giant Aetna Inc. for $37 billion still needs approval from federal anti-trust officials, partly because of the possibility that the merger will reduce competition and increase premiums.

Some other public officials, the elected kind, wasted no time weighing in on the sale. And, since it deals with health insurance, it may come as no surprise that their statements followed partisan lines, reflecting their views of the Patient Protection and Affordable Care Act.

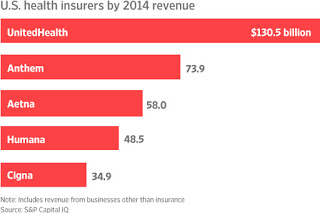

|

| Wall Street Journal graphic |

In a press release Friday, McConnell said, "This morning?s announcement, as I predicted during the debate five years ago, is the inevitable result of Obamacare?s push toward consolidation as doctors, hospitals, and insurers merge in response to an ever-growing government."

U.S. Rep. John Yarmuth, D-Louisville, said consolidation in the health-care industry has been going on for decades, "and it is appropriate for the Department of Justice to scrutinize the pending merger to ensure it does not reduce competition, and therefore, consumers' options."

Louisville Mayor Greg Fischer, a Democrat who ran in the primary for McConnell's seat in 2008, said he was "a little surprised by the political nature" of the senator's statement. Fischer and Democratic Gov. Steve Beshear were generally upbeat about the merger. "I am cautiously optimistic that this merger will be a net positive for Louisville and the commonwealth," Beshear said.

Louisville Mayor Greg Fischer, a Democrat who ran in the primary for McConnell's seat in 2008, said he was "a little surprised by the political nature" of the senator's statement. Fischer and Democratic Gov. Steve Beshear were generally upbeat about the merger. "I am cautiously optimistic that this merger will be a net positive for Louisville and the commonwealth," Beshear said.

Humana has 12,500 employees and 1,500 contractors in the Louisville area. Fischer said, "I think it's very fair to speculate that it will lead to more jobs," and Bruce Broussard, president and CEO of Humana, said, "I think Louisville will be a net beneficiary as a result of this transaction."

However, University of Louisville finance professor David Dubofsky "said it may not turn out so well for the Louisville and Humana employees after all," The Courier-Journal reports, quoting him: "When two companies in the same industry merge, and the acquirer is paying a premium, you have to generate cost savings," partly by reducing employment among workers with similar jobs.

There is a connection between the merger of health-care providers, such as the creation of Kentucky One Health by several hospital groups, and the merger of insurance companies. "Many experts have said that the provider consolidation can drive higher rates?and that more-powerful insurers might have a better chance of countering them and striking pacts for new forms of payment that incentivize efficiency," Anna Wilde Matthews and Christopher Weaver write for The Wall Street Journal.

But they also note, "Research suggests that having fewer insurers leads to higher premiums, said Leemore S. Dafny, a former Federal Trade Commission official who is a professor at Northwestern University?s Kellogg School of Management.

Aetna with Humana would dominate the Medicare Advantage market in some states, with 90 percent of it in Kansas, notes Drew Altman, president of the Kaiser Family Foundation. "Of course, regulators could insist that companies take steps to maintain more competitive markets."

The Journal reports that it analyzed a Medicare database and found, "An Aetna-Humana tie-up would increase by about 180 the number of U.S. counties where at least 75 percent of customers for Medicare Advantage plans are in the hands of a single insurer." Most of those counties are in the South and Midwest. Using another federal database, it found that "In eight states, an Aetna-Humana merger would remove a competitor from the exchanges where individuals can buy coverage under the Affordable Care Act."

The prospect that jobs might be lost in Louisville doesn't mean that the ACA has put financial pressure on Aetna or Humana, Dan Diamond writes for Forbes magazine: "There?s limited evidence that the biggest players are struggling. While the ACA capped insurers? ability to take profits, industry analysts have been fairly bullish on the sector. . . . And as I wrote earlier this week, the ACA appears to have only helped major insurers, by driving millions of new customers into the market. Aetna and Humana have seen their stock valuations triple in the past five years, since the ACA was signed into law, and the other three major insurers also have seen huge gains."

Diamond also isn't buying the argument, advanced by Aetna officials, that the combined company will be more efficient than the separate ones. "Aetna and Humana already are giant, scaled entities," he notes. "And economists aren?t buying the claim that insurer consolidation will lead to lower costs." As Judy Woodruff noted on "PBS Newshour" Friday, the deal would give the combined company more leverage to negotiate payments to health-care providers.

|

| Health insurers' shares of total Medicare Advantage business (Kaiser Family Foundation chart) |

Diamond says economists see one more possible reason for the merger: "Amid health care?s merger mania, insurers are feeling psychological pressure to make deals of their own." And that does take us back to Obamacare. But the impact on Kentucky has yet to be seen, and so do the reasons.

- Merger Mania: Aetna Bids For Humana; Cigna May Want It Too; Anthem Has Bid For Cigna; Unitedhealth Makes A Play For Aetna

Aetna Inc. has made a bid to buy Louisville-based Humana Inc.,"one of a number of recent moves by big health insurers to find merger partners," Dana Mattioli and Liz Hoffman report for The Wall Street Journal. The proposal was made in "the last few days,"...

- Humana Inc. Bus Travels The Rural Roads Of Mississippi, Looking To Enroll People In Obamacare By March 31 Deadline

Insurance providers have been scared off by Mississippi, one of the poorest and unhealthiest states in the country. Only nine percent of eligible residents have signed up for insurance under federal health reform, ranking Mississippi near the bottom of...

- At Least One Insurance Company Will Let Kentuckians Keep Their Health Insurance Plan For Another Year If They Like It

By Molly Burchett Kentucky Health News At least one insurance company, Humana, will be allowing Kentuckians to keep their insurance coverage for another year if they like it, even if the policies aren't compliant with the Patient Protection and Affordable...

- Aetna Buying Coventry, Which Manages Some Medicaid Care

Aetna will buy Coventry Health Care for about $5.6 billion as the third-largest health insurance company poises itself for more Medicare and Medicaid patients under the federal health-care reform law. Coventry Cares is one of four managed care organizations...

- Humana Reinvents Itself Again, To Adapt To U.s. Health-care Reform

Humana, Kentucky's largest corporation, says it is reinventing itself in the wake of the federal health reform law, focusing on becoming a "well-being" company rather than just a provider of health insurance. Of the notable changes, the Louisville-based...